The 8-Minute Rule for Custom Private Equity Asset Managers

(PE): spending in business that are not publicly traded. About $11 (https://justpaste.it/7f9g7). There might be a couple of things you do not comprehend about the industry.

Private equity firms have a range of financial investment preferences.

Because the best gravitate towards the larger deals, the middle market is a substantially underserved market. There are extra vendors than there are highly experienced and well-positioned financing professionals with substantial customer networks and sources to handle a bargain. The returns of private equity are commonly seen after a few years.

Getting The Custom Private Equity Asset Managers To Work

Traveling below the radar of huge multinational firms, a lot of these tiny firms typically offer higher-quality consumer solution and/or specific niche services and products that are not being used by the huge conglomerates (https://justpaste.it/7f9g7). Such upsides draw in the passion of personal equity firms, as they possess the understandings and wise to manipulate such opportunities and take the business to the following level

Private equity financiers must have trustworthy, capable, and reliable management in position. A lot of supervisors at portfolio business are given equity and reward compensation frameworks that award them for striking their monetary targets. Such positioning of objectives is commonly called for before an offer gets done. Private equity possibilities are typically unreachable for people who can not invest countless bucks, but they should not be.

There are guidelines, such as limits on the aggregate quantity of money and on the variety of non-accredited capitalists. The private equity business brings in a few of the see page very best and brightest in business America, consisting of top performers from Fortune 500 companies and elite monitoring consulting firms. Law firms can additionally be recruiting premises for personal equity employs, as accountancy and lawful abilities are required to total deals, and purchases are very demanded. https://experiment.com/users/cpequityamtx.

6 Easy Facts About Custom Private Equity Asset Managers Described

An additional downside is the lack of liquidity; when in a personal equity deal, it is not easy to obtain out of or offer. With funds under administration already in the trillions, personal equity companies have actually come to be eye-catching financial investment lorries for affluent people and organizations.

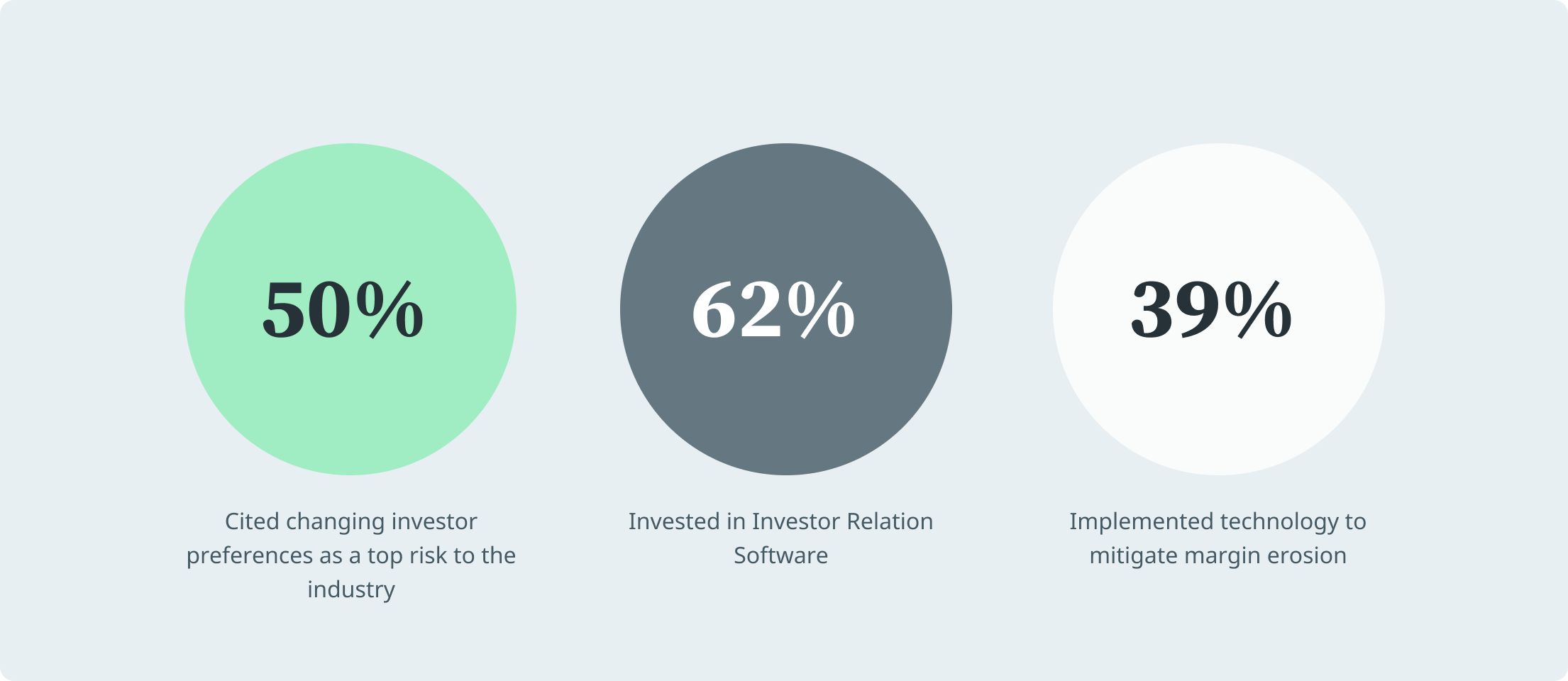

For decades, the attributes of personal equity have made the possession class an eye-catching recommendation for those that can take part. Since accessibility to personal equity is opening as much as more private capitalists, the untapped capacity is coming to be a truth. So the concern to take into consideration is: why should you spend? We'll begin with the major disagreements for buying private equity: How and why exclusive equity returns have actually historically been greater than other possessions on a variety of degrees, How consisting of exclusive equity in a profile impacts the risk-return profile, by helping to expand against market and cyclical threat, After that, we will certainly lay out some key factors to consider and threats for private equity investors.

When it concerns presenting a new property right into a portfolio, the most standard factor to consider is the risk-return account of that property. Historically, personal equity has shown returns comparable to that of Arising Market Equities and more than all various other typical asset classes. Its fairly low volatility coupled with its high returns makes for a compelling risk-return account.

Rumored Buzz on Custom Private Equity Asset Managers

Personal equity fund quartiles have the largest variety of returns throughout all different possession classes - as you can see below. Approach: Internal rate of return (IRR) spreads out computed for funds within classic years individually and afterwards balanced out. Mean IRR was determined bytaking the average of the typical IRR for funds within each vintage year.

The takeaway is that fund selection is vital. At Moonfare, we lug out a rigorous choice and due diligence procedure for all funds noted on the platform. The impact of including private equity right into a profile is - as constantly - reliant on the profile itself. A Pantheon research study from 2015 recommended that consisting of private equity in a profile of pure public equity can open 3.

On the other hand, the very best personal equity firms have access to an even bigger pool of unidentified possibilities that do not encounter the same scrutiny, along with the resources to perform due persistance on them and determine which are worth investing in (TX Trusted Private Equity Company). Spending at the very beginning indicates greater threat, yet for the firms that do prosper, the fund advantages from higher returns

Getting My Custom Private Equity Asset Managers To Work

Both public and personal equity fund managers dedicate to investing a percent of the fund but there remains a well-trodden issue with aligning passions for public equity fund monitoring: the 'principal-agent problem'. When an investor (the 'primary') works with a public fund supervisor to take control of their capital (as an 'representative') they delegate control to the supervisor while maintaining ownership of the possessions.

When it comes to private equity, the General Partner does not simply earn a monitoring cost. They additionally earn a portion of the fund's earnings in the kind of "lug" (generally 20%). This ensures that the passions of the manager are straightened with those of the investors. Exclusive equity funds also minimize an additional type of principal-agent problem.

A public equity capitalist eventually desires something - for the administration to raise the stock price and/or pay out returns. The investor has little to no control over the decision. We revealed over the number of private equity techniques - particularly bulk buyouts - take control of the running of the business, ensuring that the long-lasting worth of the company comes initially, pressing up the return on financial investment over the life of the fund.