Our Clark Wealth Partners Diaries

Table of ContentsClark Wealth Partners Fundamentals ExplainedWhat Does Clark Wealth Partners Do?The Clark Wealth Partners IdeasGetting The Clark Wealth Partners To WorkHow Clark Wealth Partners can Save You Time, Stress, and Money.More About Clark Wealth PartnersRumored Buzz on Clark Wealth PartnersThe Best Strategy To Use For Clark Wealth Partners

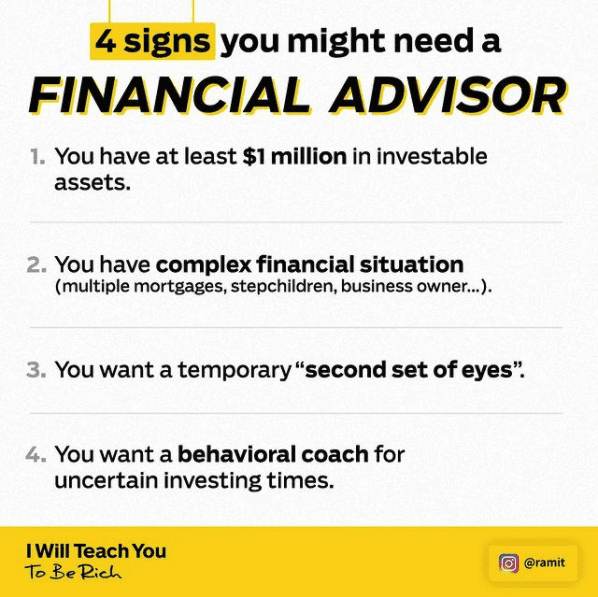

Usual factors to take into consideration an economic advisor are: If your economic situation has actually become more complicated, or you do not have self-confidence in your money-managing abilities. Saving or browsing major life events like marital relationship, separation, youngsters, inheritance, or task change that may substantially impact your economic scenario. Browsing the transition from conserving for retirement to protecting riches during retired life and how to produce a solid retirement earnings plan.New technology has caused more comprehensive automated monetary devices, like robo-advisors. It depends on you to examine and determine the right fit - https://clrkwlthprtnr.start.page. Ultimately, an excellent economic expert should be as conscious of your investments as they are with their very own, staying clear of excessive costs, conserving cash on tax obligations, and being as clear as feasible concerning your gains and losses

3 Easy Facts About Clark Wealth Partners Described

Gaining a compensation on product suggestions does not necessarily suggest your fee-based advisor works versus your finest passions. Yet they may be extra inclined to recommend items and services on which they make a compensation, which may or may not be in your ideal interest. A fiduciary is legitimately bound to put their customer's passions.

This basic allows them to make recommendations for financial investments and services as long as they fit their client's goals, danger tolerance, and monetary circumstance. On the other hand, fiduciary experts are legally obliged to act in their client's ideal rate of interest instead than their very own.

Clark Wealth Partners - The Facts

ExperienceTessa reported on all points investing deep-diving into complex economic subjects, clarifying lesser-known financial investment opportunities, and revealing methods readers can function the system to their benefit. As an individual finance professional in her 20s, Tessa is really familiar with the impacts time and uncertainty carry your financial investment decisions.

It was a targeted advertisement, and it worked. Find out more Read much less.

Examine This Report on Clark Wealth Partners

There's no single route to ending up being one, with some people starting in banking or insurance policy, while others start in accountancy. A four-year level supplies a strong foundation for occupations in financial investments, budgeting, and client services.

An Unbiased View of Clark Wealth Partners

Typical examples include the FINRA Collection 7 and Series 65 visit our website exams for safeties, or a state-issued insurance policy permit for selling life or health insurance. While qualifications might not be legitimately needed for all planning roles, employers and clients often watch them as a criteria of professionalism and reliability. We look at optional credentials in the following section.

Most monetary planners have 1-3 years of experience and familiarity with monetary products, conformity criteria, and direct customer interaction. A strong academic history is important, however experience shows the capacity to use concept in real-world settings. Some programs integrate both, permitting you to complete coursework while making monitored hours with teaching fellowships and practicums.

Some Known Incorrect Statements About Clark Wealth Partners

Lots of go into the field after functioning in banking, accounting, or insurance coverage, and the transition requires determination, networking, and usually sophisticated credentials. Very early years can bring long hours, pressure to build a customer base, and the need to constantly confirm your expertise. Still, the occupation uses strong long-lasting possibility. Financial coordinators appreciate the chance to work carefully with clients, guide essential life choices, and usually accomplish adaptability in routines or self-employment.

Wide range managers can enhance their incomes with payments, property fees, and performance benefits. Financial supervisors oversee a team of monetary organizers and consultants, setting departmental strategy, managing compliance, budgeting, and routing interior procedures. They invested much less time on the client-facing side of the sector. Virtually all monetary supervisors hold a bachelor's degree, and lots of have an MBA or similar graduate level.

Clark Wealth Partners for Dummies

Optional qualifications, such as the CFP, commonly call for additional coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Data, individual financial consultants make a mean yearly annual wage of $102,140, with leading earners making over $239,000.

In other provinces, there are policies that need them to meet particular requirements to utilize the monetary advisor or economic planner titles. For financial coordinators, there are 3 common classifications: Qualified, Individual and Registered Financial Coordinator.

Clark Wealth Partners for Beginners

Where to locate a monetary advisor will depend on the type of recommendations you need. These organizations have personnel who may assist you understand and purchase specific kinds of financial investments.